The latest smartwatch-centric data from Strategy Analytics will make great reading for Tim Cook and his executive team within Apple. The analyzed data shows that the company’s Apple Watch remained the most popular smartwatch available on the market through the fourth quarter of 2015. That remains an achievement in itself given the competition, but it’s also compounded by the fact that Apple Watch managed to capture an estimated 63-percent of the global market based on an approximate 5.1 million sales during the quarter.

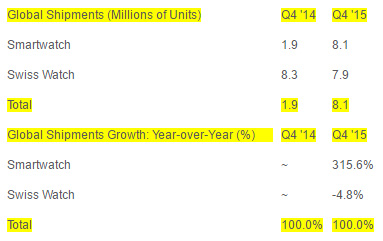

The collected stats and figures give a clear indication that the global smartwatch market is in an extremely healthy and prosperous state. Those numbers alone will encourage companies like Samsung and Apple to continue to invest time and engineering and design resources into producing their next-generation of intelligent watch products. However, the prosperous nature of the intelligent watch market appears to be in direct contrast to the Swiss watch industry. Total Swiss watch sales hit an estimated 7.9 million units in Q4 2015, down 4.8-percent when compared against the same quarter a year ago.

Neil Mawston, Executive Director at Strategy Analytics, has provided an analysis of the problems faced by the Swiss watch industry in light of the emergence of the smartwatch over recent years:

The Swiss watch industry has been very slow to react to the development of smartwatches. The Swiss watch industry has been sticking its head in the sand and hoping smartwatches will go away. Swiss brands, like Tag Heuer, accounted for a tiny 1 percent of all smartwatches shipped globally during Q4 2015, and they are long way behind Apple, Samsung and other leaders in the high-growth smartwatch category.

Not surprisingly, Samsung comes in second behind Apple in terms of smartwatch market share. Sales of Samsung smartwatches hit an estimated 1.3 million units, or 16-percent of the total market. Those numbers mean that Apple and Samsung control approximately 80-percent – or 8 out of 10 watches sold – in the global smartwatch market. The Swiss watch industry has been very slow to react to the development of smartwatches. It has been sticking its head in the sand and hoping smartwatches will go away. Swiss brands, like Tag Heuer, accounted for a tiny 1 percent of all smartwatches shipped globally during Q4 2015, and they are long way behind Apple, Samsung and other leaders in the high-growth smartwatch category.

Those figures and statistics would mean a lot more if Apple separated the Apple Watch out as its own category during its financial earnings reports. Currently, the company groups the Apple Watch together with the iPod, Apple TV, and Beats headphone sales under an “Other Products” category. We now just need to wait until the highly anticipated March 2016 media event to see if the company introduces any changes to the Apple Watch.

You can follow us on Twitter, add us to your circle on Google+ or like our Facebook page to keep yourself updated on all the latest from Microsoft, Google, Apple and the Web.